The Real Price of Solar: Understanding Your Levelized Cost of Energy

VeloSolar • Updated on February 20, 2023 • [rt_reading_time postfix=”minute”] read

VeloSolar • Updated on February 20, 2023 • [rt_reading_time postfix=”minute”] read

Grid electricity prices are increasing exponentially. Consider the state of Georgia where in 2019, state regulators approved Georgia Power’s request to raise rates by 2-2.5% in 2021 and another 4.5-5% in 2022. Fast forward to 2022 and Georgia Power is now requesting an additional 12% rate hike over the next three years.

While many of these costs can be attributed to the need to invest in modernizing infrastructure and firming up the grid, inflation is also a huge factor. The price of everything is on the rise from the gas pump to the grocery store to your utility bills.

How is a responsible business owner expected to control costs when the price of everything keeps going up? Well, one way is to own your own energy by installing a solar system.

If your business is connected to the grid, you’re buying energy from the utility to run your business. You have to pay the prices they set – including the higher prices they demand during peak hours – or you don’t get the energy.

But if you have a solar system powering your business, even partially, you own all the energy it makes. You can use as much or as little of it as you want. With batteries, you can store it to run operations overnight or in case of a grid outage, you can use it to reduce utility costs by decreasing the total amount of energy you pull from the grid, and in some places you can even sell it back to the grid.

When you own your own energy, you get to choose how you use it.

But is owning your own energy even feasible? Is it worth the investment?

When determining if a solar investment is right for you, it’s important to realize that you need to take a holistic look at the financials to make an informed decision. When it comes to solar, you’re purchasing a hedge against future energy costs and that means ROI won’t show you the real value of your investment.

When evaluating the financial aspects of a solar investment, you must consider your levelized cost of energy (LCOE).

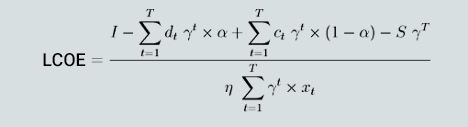

LCOE, which is expressed as a price per kilowatt hour (kWh), helps you compare two different ways of paying for energy over the same time period. In this case, you’d be comparing how much your utility-generated electricity costs are escalating over time versus the more fixed costs of electricity produced by your solar panels and battery storage system.

Think of it this way. Most renewable energy plants have a lifespan of thirty years, so first we need to know the cost of buying the solar system and how much you’ll pay for the energy it produces over that 30-year time span. Once you have the system paid for, the cost of energy produced by your solar plant is flat over time. Your only real costs are in the operations and maintenance fees (O&M), which could run as low as $0.01-0.02 per kW.

Next, you need to consider what you’d pay in utility electric bills over the same time frame. Grid electricity costs can escalate 2-5% per year (or more if inflation rates are higher), which means you could be paying on average $0.10 per kWh for grid electricity.

So now we can start to crunch the numbers, right? Not so fast.

As you can see, calculating your LCOE requires a few more data points in addition to the upfront costs, the cost of energy generated by your solar system once it’s paid for, and the cost of energy you’d otherwise buy from the utility if you don’t invest in solar.

As mentioned earlier, you also have to consider the cost of maintaining your solar system and its degradation over time. If you’ve financed your solar system, those factors will need to be included in the calculation – including whether you will outright own the system in the end or if you will lease it for the duration of its life. Tax credits like those from the solar Investment Tax Credit (ITC) or rebates you may receive are another financial data point to include.

Other considerations include the overall efficiency of the system which looks at things like the tilt angle of the panels, any shading of your panels by trees or other buildings, and the orientation of your roof.

Finally, the formula considers how the market may shift over the time frame. As we’ve seen in recent months, conflicts around the world can impact utility prices here at home and push inflation rates higher. No one has a crystal ball to be able to completely predict how the market may shift over a 30 year period, but the experts can make educated estimates.

The LCOE formula is complicated to say the least, and while there are some online LCOE calculators available, it’s best to leave the number crunching up to the experts. Experienced commercial solar companies like Velo Solar have experts on staff and finance partners that know what should and shouldn’t be considered so that you can make an informed decision.

When you know your LCOE, you can make solar decisions based on projected life-cycle costs and real economic factors. Without it, you miss the real value of solar.

AND BEGIN YOUR SOLAR JOURNEY TODAY.